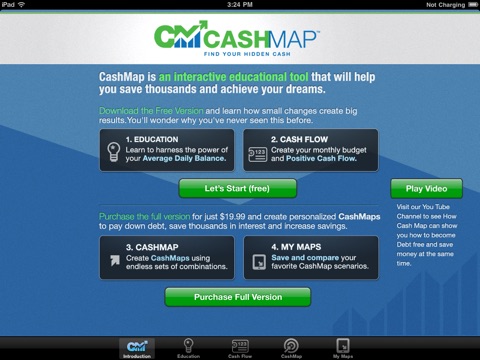

CashMap app for iPhone and iPad

Developer: Accelerated Payment Solutions LLC

First release : 15 Dec 2010

App size: 6.46 Mb

Build your wealth by putting your cash to work 24/7. Using this simple strategy can save you thousands of dollars!

Banks have been using this strategy for years! They help their best clients use it too. Learn to safely use a line of credit to use your banks money to help you achieve your financial goals.

Visit www.dennis-williams.com and review our wide range of articles and interactive tools that will help you feel comfortable keeping your dollars working for you 24/7. Youll find my free e-book, Create Your Line of Credit Scenario and coaching services.

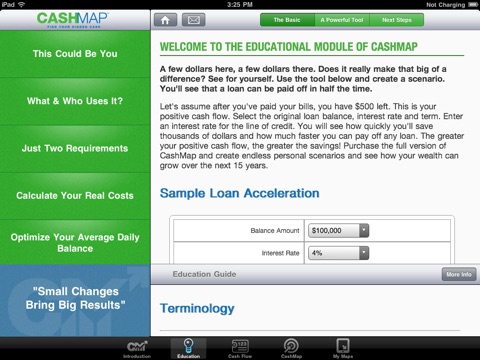

Each step of the way, CashMap shows you what to do, how to do it and lets you see how your financial picture can grow over the next 15 years.

You’ll save thousands of dollars in interest, pay off your loans faster and boost your savings by following these simple steps.

1. Accelerate your loans amortization schedule by using a line of credit.

2. CashMap shows you when and how much to withdraw from your line of credit.

3. Dramatically lower your interest cost by moving all your income to your line of credit.

4. Minimize your interest cost by paying your expenses from your line of credit at the end of your line of credits billing cycle.

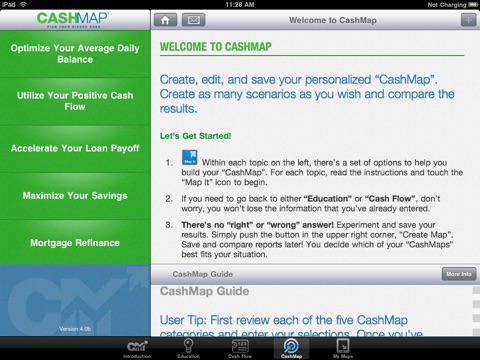

Using the full version of CashMap youll create your personalized scenario by using the following five sections.

•Optimize Your Average Daily Balance – Identify your income dates and payment dates and make the most of your average daily balance. The better your average daily balance, the greater your savings!

•Utilize Your Positive Cash Flow – Forecast your future positive cash flow by projecting: annual increases, future savings and changes in your monthly expenses.

•Accelerate Your Loan – Choose a loan and see how much earlier you can pay it off savings thousands in interest and boosting your savings. Share your report with your banker – they’ll be amazed!

•Maximize Your Savings – Create your emergency fund goal, choose the interest rate you’ll earn on your savings and see your results.

•Refinance Your Mortgage – Choose the interest rate and the amortization period and see how much more you can save in interest and boost your savings.

Each section creates detailed results that you can save and compare against other scenarios you create. You now have the detail necessary to make your plan come to life.